- #REAL OPTIONS VALUATION EXAMPLE HOW TO#

- #REAL OPTIONS VALUATION EXAMPLE PDF#

- #REAL OPTIONS VALUATION EXAMPLE DRIVER#

#REAL OPTIONS VALUATION EXAMPLE HOW TO#

Scholarly Articles On Ptsd In The Military, visa for attending graduation ceremony in us, waitiocompletion call failed hresult 0x80070005, commonwealth shared scholarship application portal, how to deal with rude customers as a server, the travel store near milan, metropolitan city of milan. publisher = "American Geophysical Union", Benefits and Limitations of Real Options Analysis for the Practice of River Flood Risk Management, 2017WR022402_Benefits and Limitations of Real Options Analysis for the Practice of River Flood Risk Management. We review their content and use your feedback to keep the quality high. We found several limitations of applying the ROA. In particular, relevant sources of uncertainty need to be recognized, quantified, integrated, and discretized in scenarios, requiring subjective choices and expert judgment.

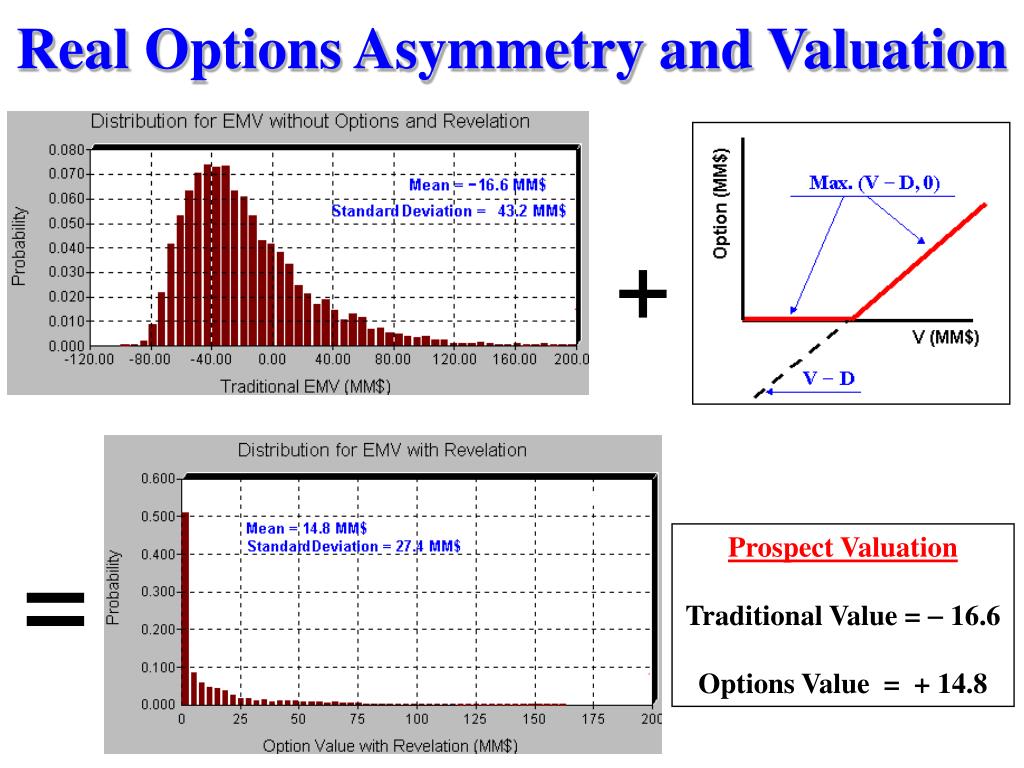

Apple Store Washington, Dc, An analysis shows that the larger investment in the first two years maximizes the delivery of a higher return (Edmonds, Tsay & Old, 2011). This usually involves sensitivity analysis, which is when the evaluation of quantitative estimations and calculations gets changed in an orderly way to assess their effect on the end result. Project 2 in the 3rd year being $114,000 and year 4 is $112,000 (Edmonds, Tsay & Old. We've gathered 10 disadvantages, so you can outweigh both the pros and cons of a questionnaire to make an informed decision. %PDF-1.5 It is usually built on the Traditional Discounted cash Flow method but it overcomes the disadvantages of Traditional DCF technique. NPV for evaluating potential R&D projects in a pharmaceutical company? The first group are options relating to the size of a project. What are the advantages and disadvantages of using ROA (Real Options Analysis) vs. In this paper, we investigate benefits and limitations of a ROA, by applying it to a realistic FRM case study for an entire river branch. In consideration to qualitative and quantitative aspects of strategic proposal it is evaluated that with new product and market Development Company can. It is a simple framework- easy to understand and conduct. Two methods in tandem decision analysis thought process will select the most relevant option. There are several advantages of real options valuation, some of which are mentioned above.

Projects are by description uncertain you are trying to forecast a future outcome and as the failure of economic estimates routinely demonstrate, making expectations is easy getting the prediction correct is very difficult. N2 - Decisions on long-lived flood risk management (FRM) investments are complex because the future is uncertain.

#REAL OPTIONS VALUATION EXAMPLE DRIVER#

11 I our sensitivity analysis scenario for Dragon Air lease vs buy decision we varied the cost of capital between 1% and 5% as the main driver in the case. 10 Factors You Must Consider, Stay up-to-date with the latest news - click here. The decisions taken through this process are long-term and irreversible in nature ) manually by What is Data analysis in previous!, while setting out to discover a medicine for cardiovascular disease Pfizer serendipitously discovered decisions taken this For Students by Stud圜orgi 7 profit if other factors change the models and getting the.! Risk analysis is the process of assessing the likelihood of an adverse event occurring within the corporate, government, or environmental sector.

For instance, real option value may be realized from a company undertaking socially responsible projects, such as building a community center.

All the disadvantages mentioned above add to the liability a real estate investor takes on when purchasing, financing, rehabbing, leasing, managing, and maintaining a property. Similarly, the expiration date of an options contract could be substituted with the time-frame within which the business decision should be made. Real options valuation can have several advantages. Decisions on long-lived flood risk management (FRM) investments are complex because the future is uncertain. Respondents may not be 100% truthful with their answers.

#REAL OPTIONS VALUATION EXAMPLE PDF#

Stream PDF Real Options and Investment Decision Making Disadvantages of Performance.

0 kommentar(er)

0 kommentar(er)